Please be advised that contacting Ruder Ware by e-mail does not create an attorney-client relationship. If you contact the firm by e-mail with respect to a matter where the firm does not already represent you, any information which you disclose to us may not be regarded as privileged or confidential.

For developers, adeptly navigating the intricate web of zoning laws and regulations is paramount to ensuring that projects not only comply with local ordinances but also align with community standards. Understanding Zoning Regulations Zoning laws are essential for urban planning, dictating how land can be used. They help maintain order and prevent conflicts between different […]

On March 12th, the Department of Homeland Security published an Interim Final Rule (“IFR”) partially implementing section 7 of Executive Order 14159, Protecting the American People Against Invasion (Jan. 20, 2025) (the “Executive Order”). Section 7 of the Executive Order directed the Secretary of Homeland Security, and others, to ensure that all previously unregistered noncitizens […]

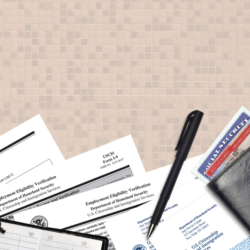

On April 2nd, USCIS announced they had made available a revised Form I-9 for employment eligibility verification. The new form, available at the USCIS website, has an edition date of 01/20/25 and an expiration date of 05/31/27. USCIS will also continue to accept the following previous versions of the form: Form I-9 (08/01/2023 edition) with […]

On May 1, 2025, the IRS announced the Health Savings Account limits for 2026. With respect to contribution limits, the limits are slightly higher than the ones for 2025 and the required deductible and out-of-pocket maximums have increased as well. As a reminder, these inflation adjusted amounts are effective for calendar year 2026. HSA/HDHP Requirement […]